Life Insurance in and around Vancouver

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Would you like to create a personalized life quote?

Be There For Your Loved Ones

The common cost of funerals nowadays is around $8,300, according a recent study by the National Funeral Directors Association. Unfortunately, it may be difficult for your loved ones to pay for your funeral as they mourn. That's where Life insurance with State Farm comes in. Having the right coverage can help those closest to you pay any outstanding bills and not experience financial hardship.

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Why Vancouver Chooses State Farm

Fortunately, State Farm offers numerous coverage options that can be personalized to accommodate the needs of your loved ones and their unique situation. Agent Jim Riley has the personal attention and service you're looking for to help you opt for coverage which can assist your loved ones in the wake of loss.

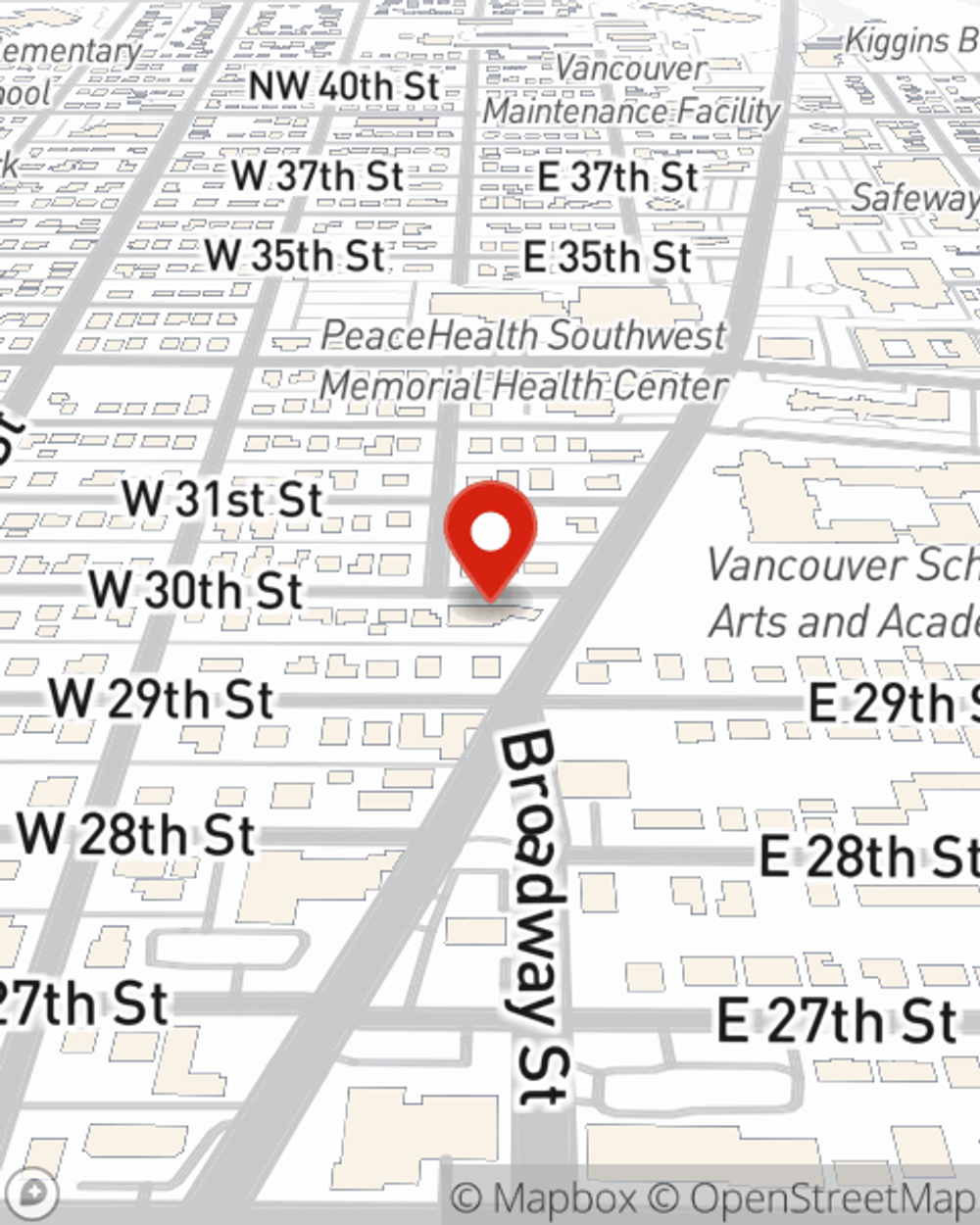

Simply visit State Farm agent Jim Riley's office today to see how the State Farm brand can help cover your loved ones.

Have More Questions About Life Insurance?

Call Jim at (360) 859-0019 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.